Here’s how you can budget any Income using a simple budgeting criteria that I use and would recommend.

Categorize your money into 5 simple basics:

1. Savings

2. Rent, electricity, water, WIFI

3. Food, fare, shopping

4. Commitments (school fees, sending money home)

5. Comforts/ Luxuries

Budgeting Kes 60,000 Net Income

We will compare three types of budgets:

- Gamma is a bachelor who recently graduated (No commitments )

In this case :

- Gamma does not have any obligations

- He saves Kes 19,300

| Budgeting | Money In | Money Out | Comment |

|---|---|---|---|

| Income after taxes | 60,000.00 | ||

| Savings | 19,300.00 | ||

| Basic Expenses | |||

| Rent,electricity, water | 15,000.00 | ||

| Food (breakfast, lunch and supper) | 11,200.00 | Kes 400*7 days*4weeks | |

| Fare | 4,000.00 | Kes 200*5 days*4weeks | |

| Shopping | 4,500.00 | ||

| Fun/luxuries | 6,000.00 | ||

| 60,000.00 | 60,000.00 |

2. Gamma is bachelor but has commitments

- He pays for his brother’s school fees

| Budgetiing | Money In | Money Out | Comment | |

| Income after taxes | 60,000.00 | |||

| Savings | 9,300.00 | |||

| Basic Expenses | ||||

| Rent,electricity, water | 15,000.00 | |||

| Food (breakfast, lunch and supper) | 11,200.00 | Kes 400*7 days*4weeks | ||

| Fare | 4,000.00 | Kes 200*5 days*4weeks | ||

| Shopping | 4,500.00 | |||

| Fun/luxuries | 6,000.00 | |||

| Extra expenses | ||||

| Loans/school fees/black tax | 10,000.00 | |||

| 60,000.00 | 60,000.00 |

3. Gamma has a young family and commitments

- In this case, the expenses increase like rent, food

- The savings reduce

| Gamma with a Family of 2 young children | |||||

| Budgeting | Money In | Money Out | Comment | ||

| Income after taxes | 60,000.00 | ||||

| Savings | 5,000.00 | ||||

| Basic Expenses | |||||

| Rent,electricity, water | 17,000.00 | ||||

| Food (breakfast, lunch and supper) | 14,000.00 | Kes 500*7 days*4weeks | |||

| Fare | 4,000.00 | Kes 200*5 days*4weeks | |||

| Shopping | 6,000.00 | ||||

| Fun/luxuries | 4,000.00 | ||||

| Extra expenses | |||||

| Loans/school fees/black tax | 10,000.00 | Saving every month for the next term (10,000*4 months) | |||

| 60,000.00 | 60,000.00 | ||||

| Source: www.ivyoyori.com | |||||

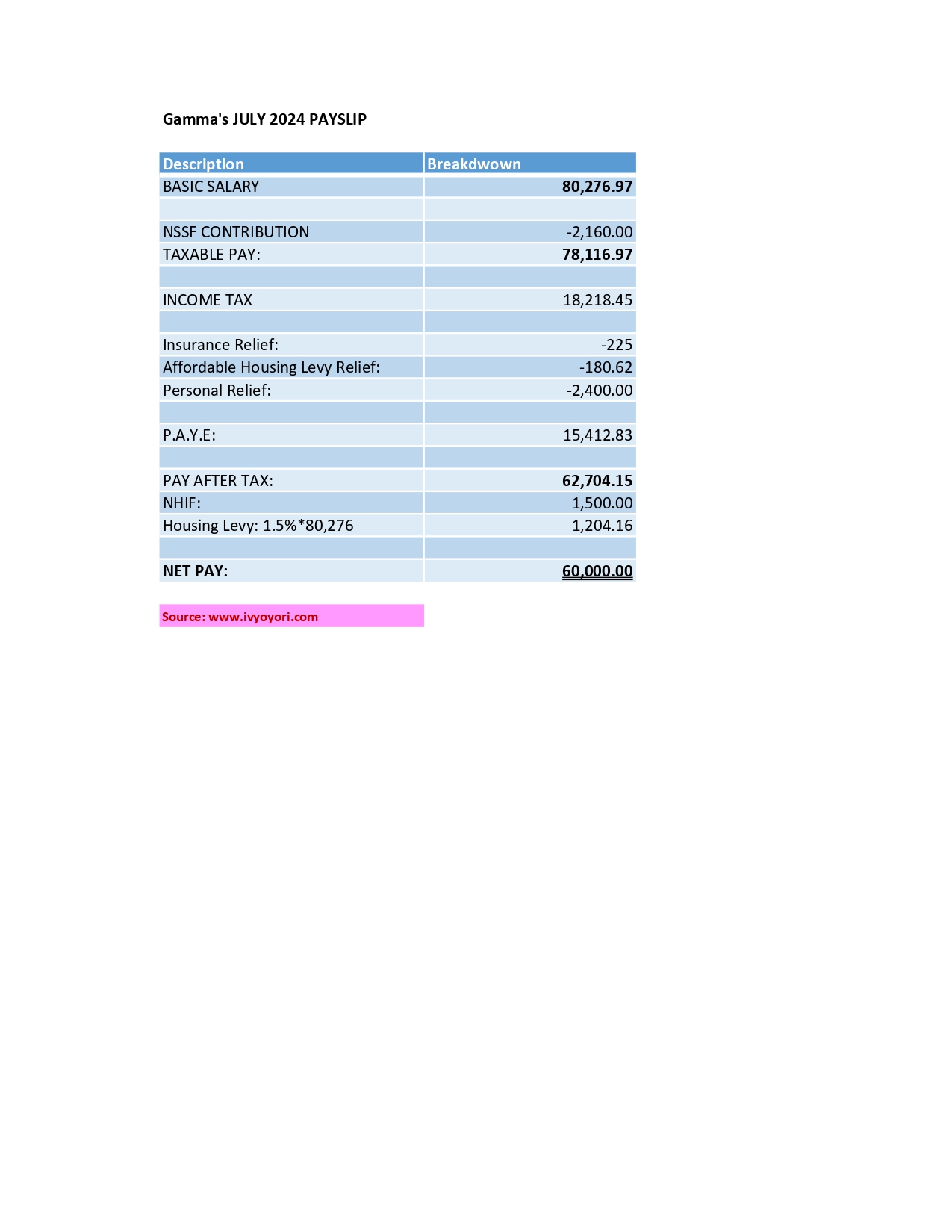

Just to be clear, the Kes 60,000 budgeting is net income (The income that actually hits the bank the account after all taxes and other deductions like pension and NHIF have been deducted.

How a net pay of Kes 60,000 payslip looks like in Kenya