Treasury bills (T-bills) are a great way to invest your money in a safe and predictable way. In this blog, we’ll break down how to calculate your returns when investing in T-bills using a real example:

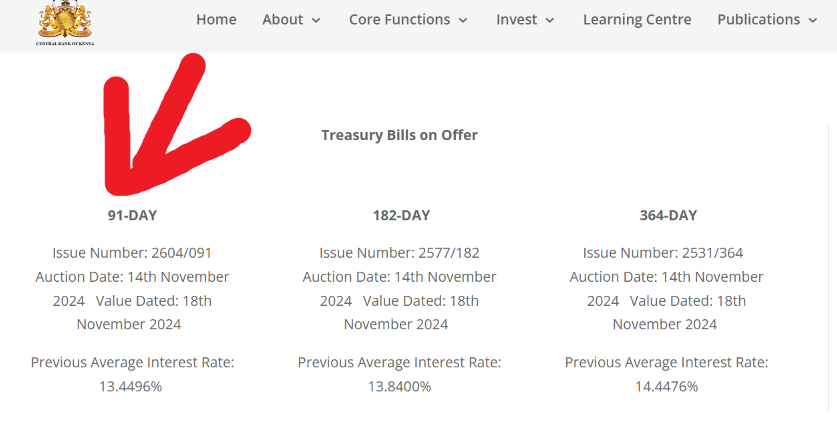

Example: 91-Day Treasury Bill Investment in Kenya

Example 1 :Investment Details:

- Investment Amount: KES 100,000

- Duration: 91 days

- Interest Rate (Discount Rate): 13.4496%

Let’s calculate how much you’ll earn and the total payout at maturity.

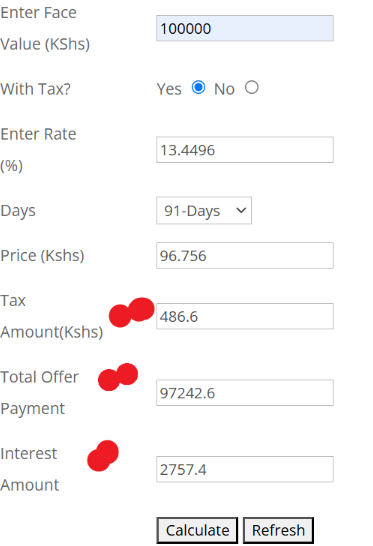

I will be using this treasury bill calculator click here

Results of Calculation

Interpretation of the results

You will lend the government = Kes 97,242.60 (96,756+ Tax on discount 486.6 )

At the end of 91 days you will receive= Kes 100,000

You earned an interest = Kes 2,757.

Key Points to Remember

- Treasury Bills Are Sold at a Discount: You pay less than the face value upfront and receive the full amount at maturity.

- Interest Is Pre-Determined: The discount rate ensures your returns are fixed, making T-bills a predictable investment.

- Minimum Investment: In Kenya, the minimum investment for T-bills is KES 100,000, with increments of KES 50,000 for additional investments.

Why Invest in Treasury Bills?

- Low Risk: Backed by the government.

- Short-Term Investment: Ideal for investors looking for returns in under a year.

- Steady Returns: Fixed rates protect you from market volatility.

To learn more about treasury bills and treasury bonds , grab this E-book on investing in shares @Kes 500 here

Overline

Ebook – Investing in Treasury bills and treasury bonds in Kenya

This 44-page e-book is your is your ultimate guide to understanding treasury bills and bonds with clarity, covering essential topics like:

- Detailed Calculations on Treasury bill and bond returns

- Benefits & Risks of these investments

- Comparisons of 91, 182, and 364-day Treasury Bills

- Understanding reopened bonds issued at a discount

- Treasury Bills vs. Money Market Funds

Whether you’re new to investing or aiming to diversify, this guide is designed to help you make informed financial decisions.

Thank you for your purchase, and enjoy your journey to smarter investing!