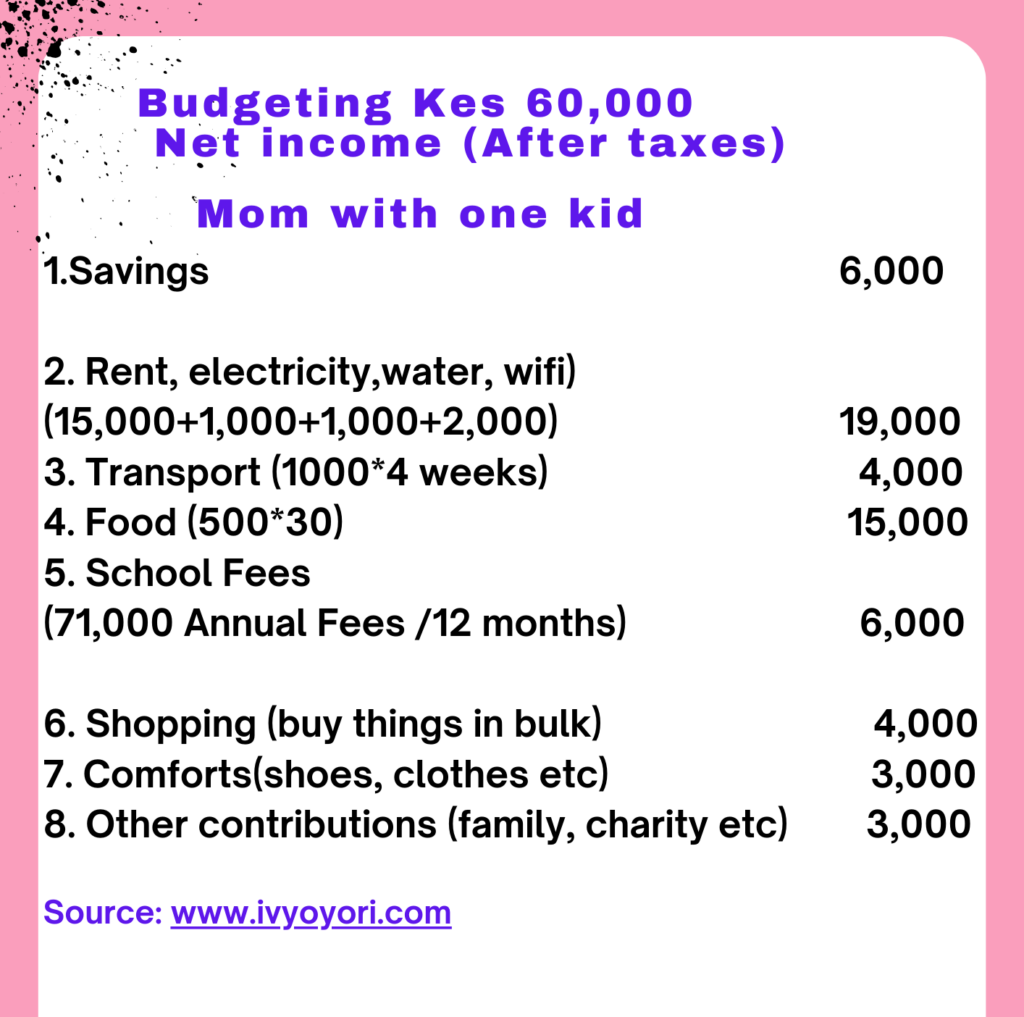

With a net income of KES 60,000, it’s essential to allocate funds wisely to ensure that all family needs are met.

In this post, we’ll explore a sample budget breakdown for a mom with one child and provide tips on how to manage finances effectively.

Understanding Your Monthly Budget

When working with a fixed income, the first step is understanding your necessary expenses and saving priorities. Here’s a look at a sample budget for a mom managing KES 60,000 per month:

Monthly Income: KES 60,000

1. Savings: KES 6,000

Setting aside money for savings is crucial. Aim for at least 10% of your income to build an emergency fund or save for future expenses.

2. Rent and Utilities: KES 19,000

- Rent: KES 15,000

- Electricity and Water: KES 1,000 each

- Wi-Fi: KES 2,000

These essential expenses should take priority. Always ensure your rent and utility bills are manageable within your income.

3. Transport: KES 4,000

Allocate funds for transportation, especially if commuting is necessary for work or school.

4. Food: KES 15,000

Plan your meals wisely to avoid overspending. This budget allows approximately KES 500 per day for groceries.

5. School Fees: KES 6,000

Education is a priority. The school fees budget is based on an annual fee of KES 71,000, divided into monthly payments.

6. Shopping (Bulk Purchases): KES 4,000

Buying in bulk can save money in the long run. Consider purchasing non-perishable items in larger quantities.

7. Comforts: KES 3,000

Allocate some funds for clothes and other comforts. Balance is key, so ensure these purchases don’t interfere with essential spending.

8. Other Contributions: KES 3,000

Include a small budget for family or charitable contributions to support your loved ones and community.

Check out this Monthly Budget Calculator to help you estimate how much money to be setting aside for savings.

What do you think of this budget? Is it realistic?