WHAT IS SHIF ? and how is shif different from nhif?

As part of efforts to improve healthcare in Kenya, the government is transitioning from NHIF to SHIF. This change will introduce new health insurance contribution rates that will affect every employee’s salary. If you’re currently earning KES 60,000 or more, it’s important to understand how this shift will impact your take-home pay.

1. SHIF Contribution Rates

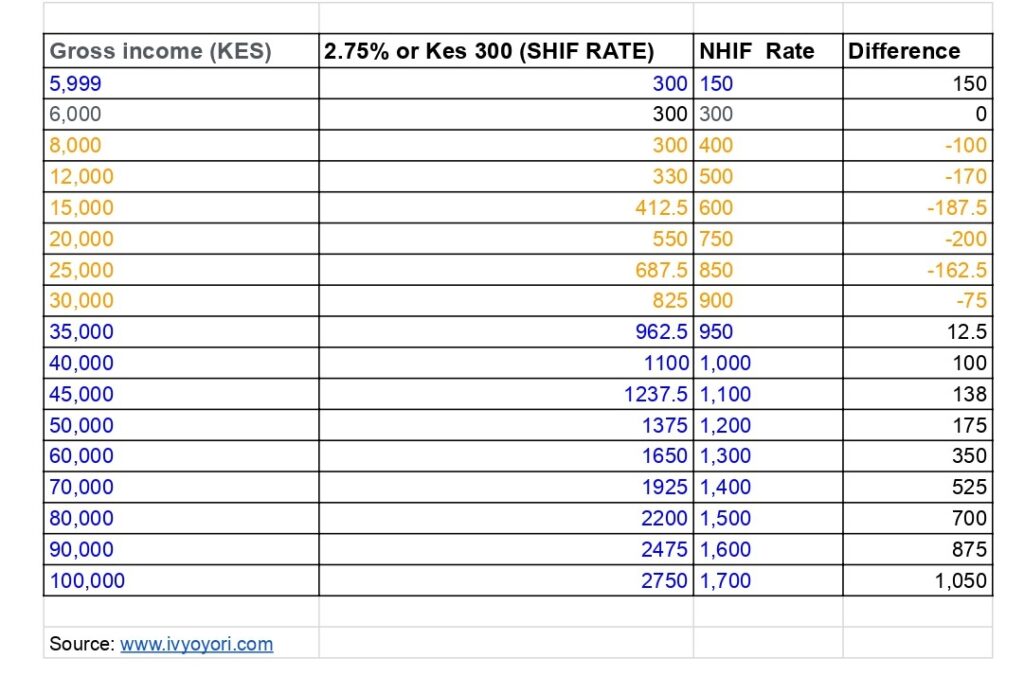

The most notable change under SHIF is the new percentage-based contribution model. While NHIF had tiered rates, SHIF introduces a flat 2.75% contribution on gross income for all.

NHIF: Contributions were based on a tiered structure, with employees earning KES 60,000 contributing KES 1,300 monthly.

SHIF: Contributions are now 2.75% of gross income, meaning if you earn KES 60,000, your SHIF contribution will be KES 1,650.

This results in an additional KES 350 in deductions each month compared to the NHIF system.

2. Impact on PAYE Deductions and Disposable Income

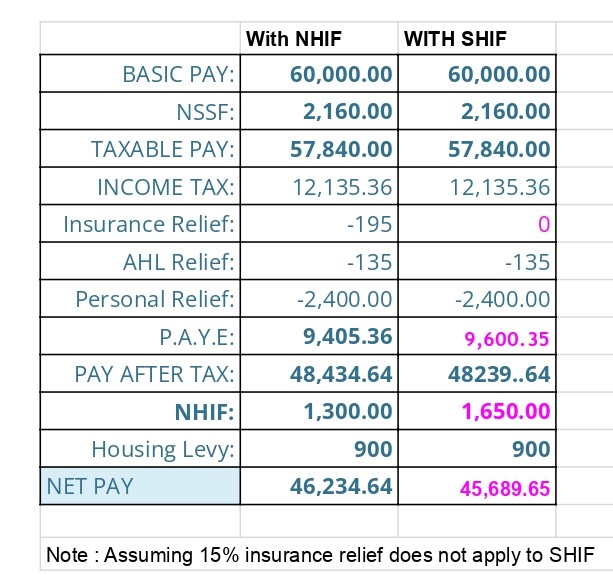

Under NHIF, employees received a 15% tax relief on their health insurance contributions, which helped reduce their overall PAYE (Pay-As-You-Earn) tax. With SHIF, this tax relief may no longer apply, leading to a potential increase in your PAYE tax deductions and a reduction in your net pay.

For example, if you earned KES 60,000, your SHIF contribution will be KES 1,650. If the 15% health insurance tax relief is removed, your take-home pay will decrease.

But we are still not sure if the health insurance relief will be applied or not.

Example: How SHIF Will Affect a KES 60,000 Payslip

Here’s a practical example of how SHIF will affect your payslip compared to NHIF if you’re earning KES 60,000:

- NHIF Contribution: KES 1,300

- SHIF Contribution: KES 1,650 (2.75% of KES 60,000)

- Difference: You will pay KES 350 more each month under SHIF.

In addition, if the 15% health insurance tax relief is no longer applied, your PAYE tax will increase, further reducing your take-home pay.

SHIF Contributions for Self-Employed Individuals

If you’re self-employed, SHIF also introduces changes to your contributions:

- Minimum Contribution: SHIF’s minimum contribution is KES 300 per month, up from the KES 150 required under NHIF.

- Percentage Contribution: Self-employed individuals will contribute 2.75% of their declared gross income to SHIF.

This means that depending on your reported income, your contribution could increase under SHIF compared to the flat rates previously required under NHIF.

Prepare for Changes in Your Payslip

The transition from NHIF to SHIF represents a significant shift in healthcare contributions in Kenya. For employees earning KES 60,000 or more, this means higher deductions for health insurance—KES 1,650 compared to KES 1,300 under NHIF. Self-employed individuals will also face new contribution rates based on their gross income, making it important to adjust your budget accordingly.

If you want to understand more about how SHIF will impact your finances, stay updated with the latest news and check out our detailed YouTube video.