INVESTING IN MONEY MARKET FUNDS

What is a Money Market Fund (MMF) Account and how does it work?

A money market fund account is a short term low- risk savings account that earns you interest.

Short- term means you can save and access your money within a one year period.

In fact with MMFS, you can access your money in less than 48hrs in Kenya.

Money in this account earns interest daily and is compounding (You earn interest on top of the interest you have already earned) and you can withdraw your money any time without incurring a penalty.

How does it work?

Think of it this way.

Different People save their money together in one account, and the money in that account is used to invest in low-risk short-term investments and when profits are earned, they are shared with you in the form of interest.

Funds in MMF are used to make investments in:

- Treasury bills (T-bills) and Treasury Bonds –When the government borrows money from the members of the public. A treasury bill -when the government returns the money in less than a year. A treasury bond – when the government will return your money in 2-30 years

- Fixed deposits – The funds are locked in bank savings accounts that earn a fixed interest for a specific period of time.

- Commercial Paper – Large businesses or corporations borrow money to meet urgent needs like paying salaries and other operations and they pay back the loan within 270 days.

Who operates MMFS?

- Banks like NCBA, Stanchart

- Insurance companies like CiC, Madison, Sanlam etc

- Wealth and Asset management firms like Nabo Capital, Enwealth etc

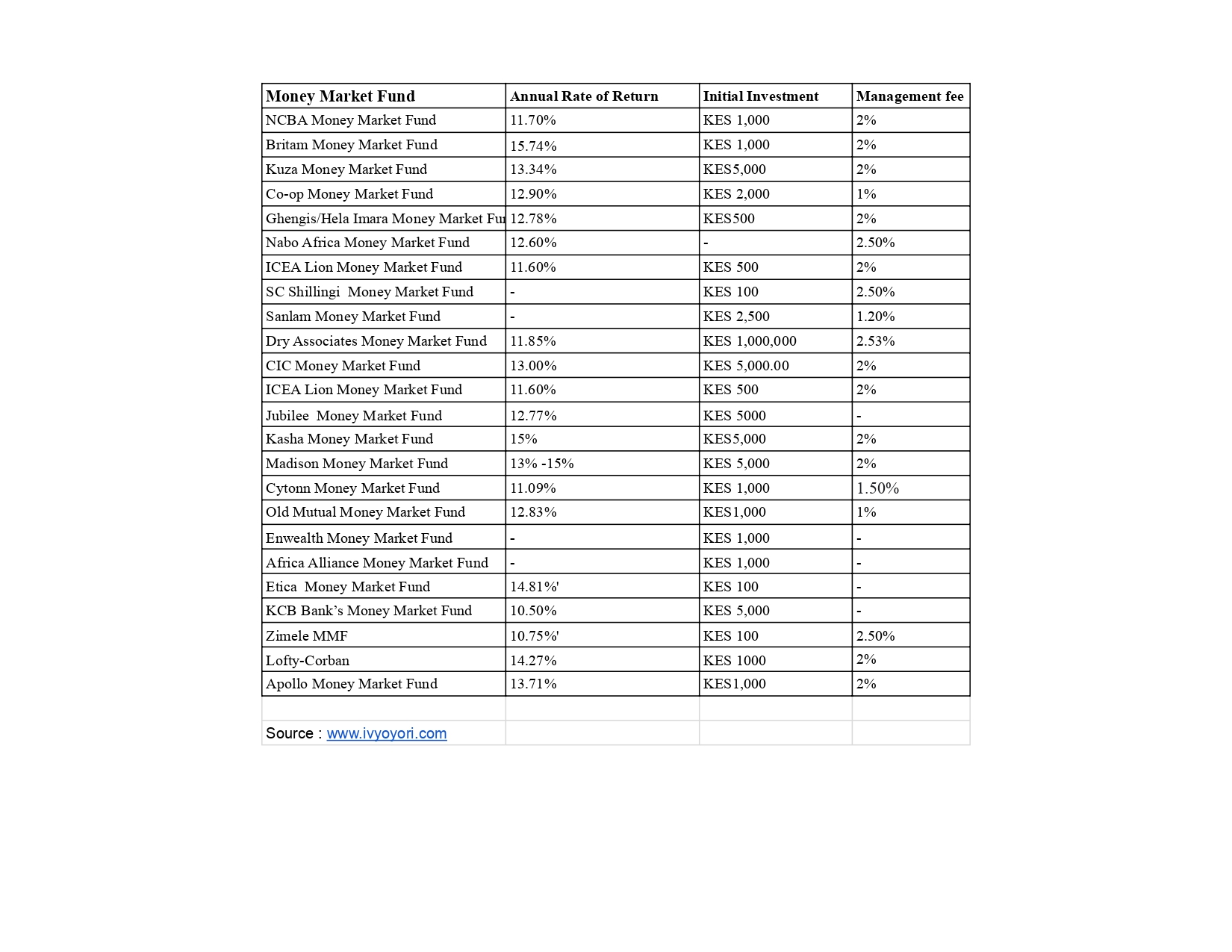

List 0f Money Market Funds In Kenya